Navigating the Financial Landscape: The Rise of Loan Aggregator Platforms

Tagged as: .

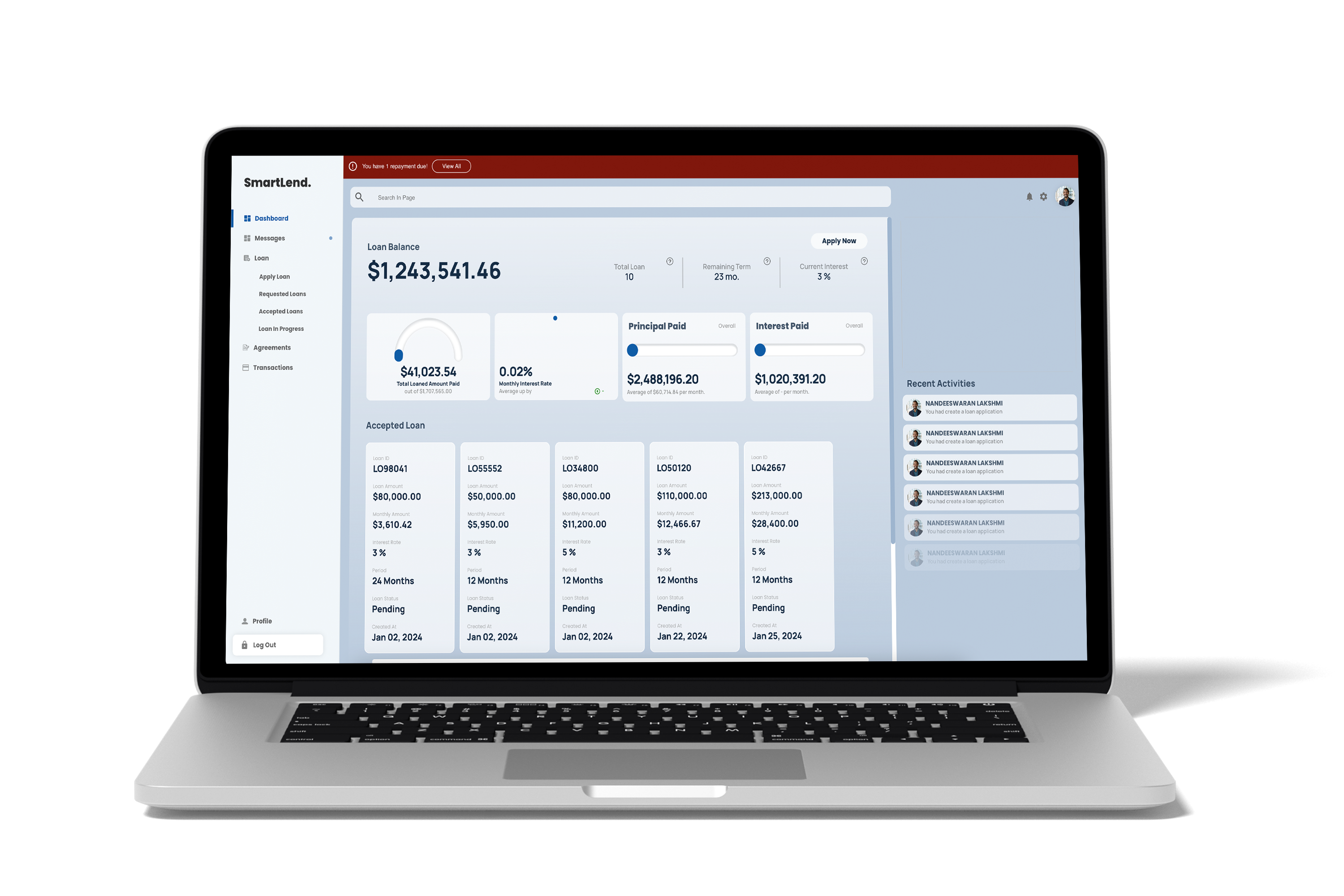

In the digital age, the financial sector has undergone a significant transformation, with technology playing a pivotal role in reshaping how consumers access financial services. One of the most notable advancements in this domain is the emergence of Loan Aggregator Platform These platforms have revolutionized the way individuals and businesses find and compare loan options, offering a more efficient, transparent, and user-friendly approach to borrowing.

Understanding Loan Aggregator Platforms

A loan aggregator platform is an online service that compiles loan offers from various lenders, allowing borrowers to compare different loan products in one place. These platforms typically include a wide range of loans, such as personal loans, home loans, auto loans, and business loans. By aggregating multiple loan options, these platforms provide a comprehensive overview of available financial products, making it easier for borrowers to find loans that best suit their needs.

How Loan Aggregator Platforms Work

The process begins when a user visits a loan aggregator platform and inputs their loan requirements, such as the loan amount, purpose, and tenure. The platform then uses this information to fetch loan offers from its network of lenders. This network can include banks, credit unions, online lenders, and peer-to-peer lending platforms. The user is then presented with a list of loan options, complete with details such as interest rates, fees, repayment terms, and eligibility criteria.

One of the key advantages of loan aggregator platforms is the ability to perform side-by-side comparisons of different loan products. This feature empowers borrowers to make informed decisions based on their specific financial situations. Additionally, many loan aggregator platforms offer tools and calculators that help users estimate their monthly payments, total interest costs, and other important metrics.

Benefits of Loan Aggregator Platforms

Convenience and Accessibility: Loan aggregator platforms provide a one-stop-shop for borrowers, eliminating the need to visit multiple bank branches or websites. This convenience is particularly beneficial for individuals with busy schedules or those living in remote areas with limited access to physical bank locations.

Transparency: These platforms promote transparency by displaying all relevant loan information in a clear and organized manner. Borrowers can easily compare interest rates, fees, and other terms, ensuring they understand the full cost of the loan before committing.

Competitive Rates: By showcasing loan offers from multiple lenders, loan aggregator platforms encourage competition among lenders. This competition often results in better interest rates and terms for borrowers.

Speed and Efficiency: The digital nature of loan aggregator platforms means that borrowers can receive loan offers and complete applications quickly. This efficiency is crucial in situations where funds are needed urgently.

Personalized Offers: Many loan aggregator platforms use advanced algorithms and data analysis to provide personalized loan recommendations based on the borrower’s credit profile and financial history. This personalization increases the likelihood of finding a Loan For Business Startups In Singapore that matches the borrower’s needs and eligibility.

The Future of Loan Aggregator Platforms

As technology continues to evolve, loan aggregator platforms are expected to become even more sophisticated. The integration of artificial intelligence (AI) and machine learning can enhance the accuracy of loan recommendations and improve user experience. Additionally, the expansion of open banking and increased collaboration between fintech companies and traditional financial institutions could further enhance the capabilities of these platforms.

Furthermore, as consumer awareness and trust in digital financial services grow, loan aggregator platforms are likely to see increased adoption. This trend will drive further innovation and competition in the lending industry, ultimately benefiting borrowers.

For more in-depth information, visit our website.